Connecting Kount

Setup

To set up Kount, you need to perform these steps:

Step 1

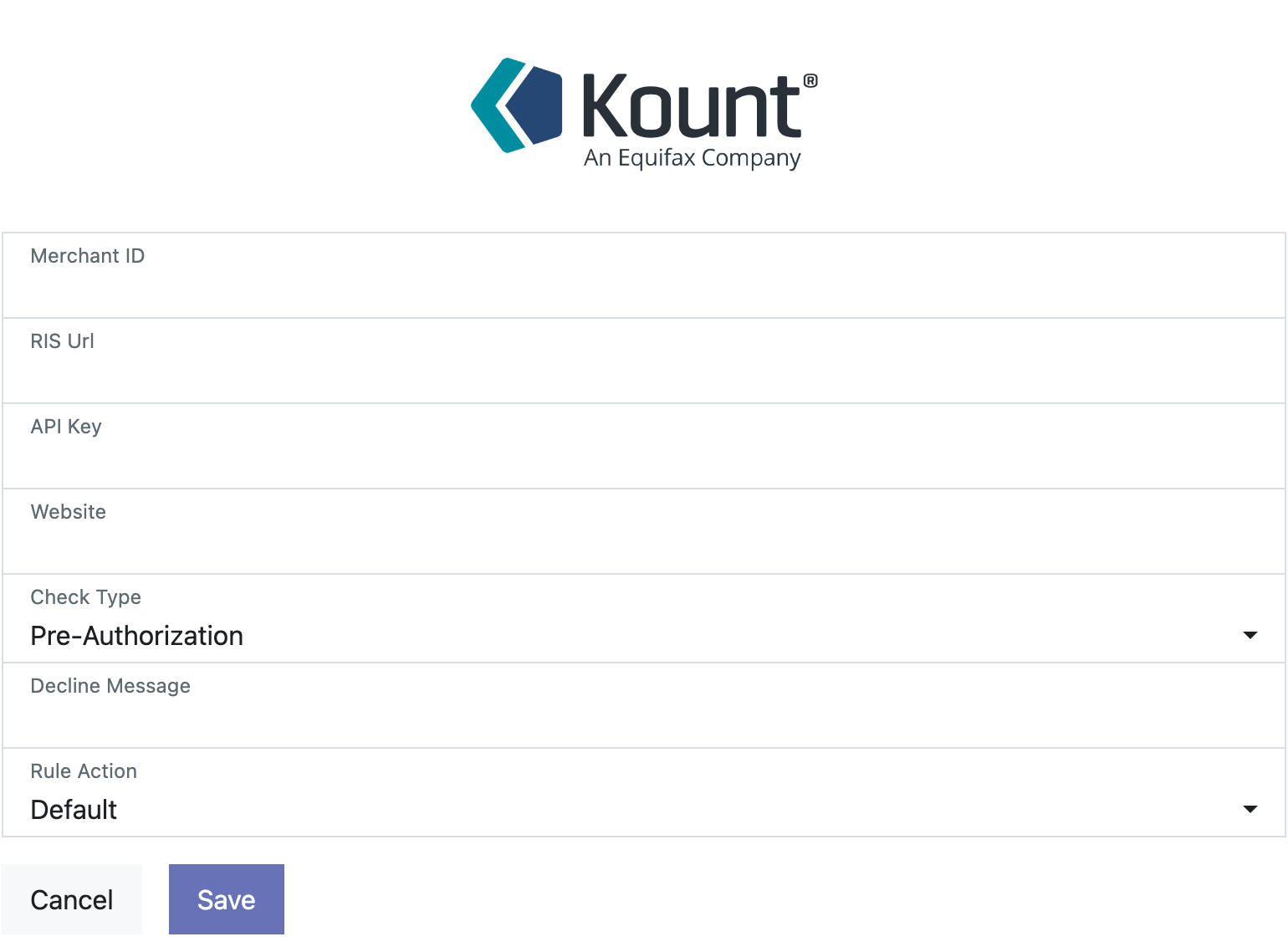

In order to use Kount directly in Enterprise mode, you will need to obtain your credentials from Kount. These credentials are typically provided by Kount directly to the customer who will be using their services. Once you have received your credentials from Kount, you will need to enter them on the connector screen or integrate them into your system to establish a connection with Kount's services.

On the other hand, if you are using Kount through a software vendor or third-party integration, the credentials will be supplied by your software vendor.

Step 2

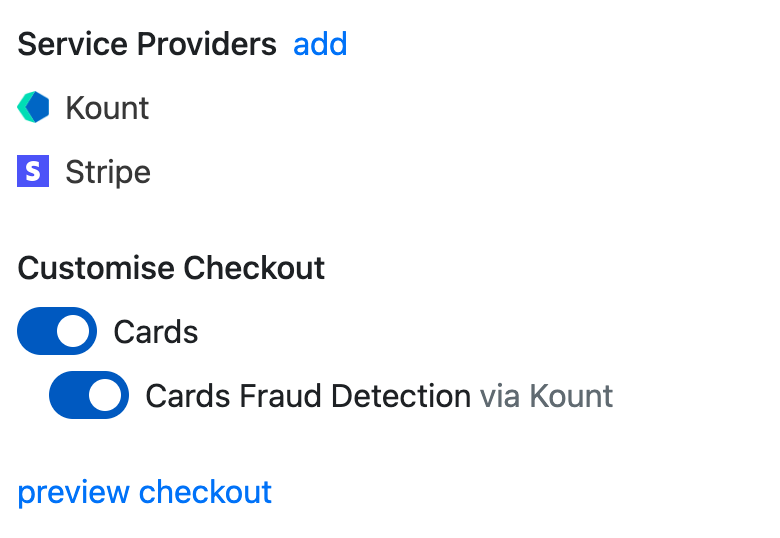

To enable Kount fraud protection for every payment method, use the provided sliders in the settings to enable Kount for each payment method individually. See image below.

You're now ready to take payments.

What payment methods does Kount work with?

Kount only displays for “Card”, “SEPA” and “ACH” only. That means it DOESN’T work for:

- Any hosted process (eg GoCardless, Mollie, Paypal, Klarna etc)

- Hosted card processes e.g. Transbank

- Hosted ACH processes e.g. the Stripe ACH upgrade (open banking)

- Hosted SEPA processed e.g.Mollie

- Integrated iFrames payment processes, e.g. Paypal cards form inside their iFrame

** It is indeed recommended to avoid explicitly indicating suspicion of fraudulent activity in the decline message to the end customer. Instead, a message like "Your payment is pending, we will be in touch regarding your order." can be used.

By providing a neutral message, the intent is to avoid alerting potential fraudsters about the fraud detection measures in place and not providing them with immediate feedback on their suspicious activities. This approach helps maintain the security and effectiveness of the fraud detection system. **