How to use Kount with Shuttle and your software

I want to introduce how Kount works.

Kount as you may know, is a fraud tool and fits into the workflow between the checkout and the payment method. Kount helps merchants reduce fraud and increase sales.

Kount can operate in two flavours. In both scenarios, you get the same Kount fraud fighting abilities.

- Firstly, the Enterprise mode -- where a merchant purchases and uses Kount to reduce their fraud. The merchant will be given a Kount login where they can view the escalated transactions and manually approve them to go through the payment process or fail them to return to the customer.

- The second mode is what Kount call, Portfolio mode -- where the software vendor purchases Kount for merchants to use. There is no Kount login for the merchant and no escalation process within Kount. The overall rule set is also configured by the software vendor. Of course you still get Kount’s machine learning and protection. The merchant will have to use the UI of the software vendor if they choose to review fraudulent looking transactions.

Let’s show you how to enable Kount:

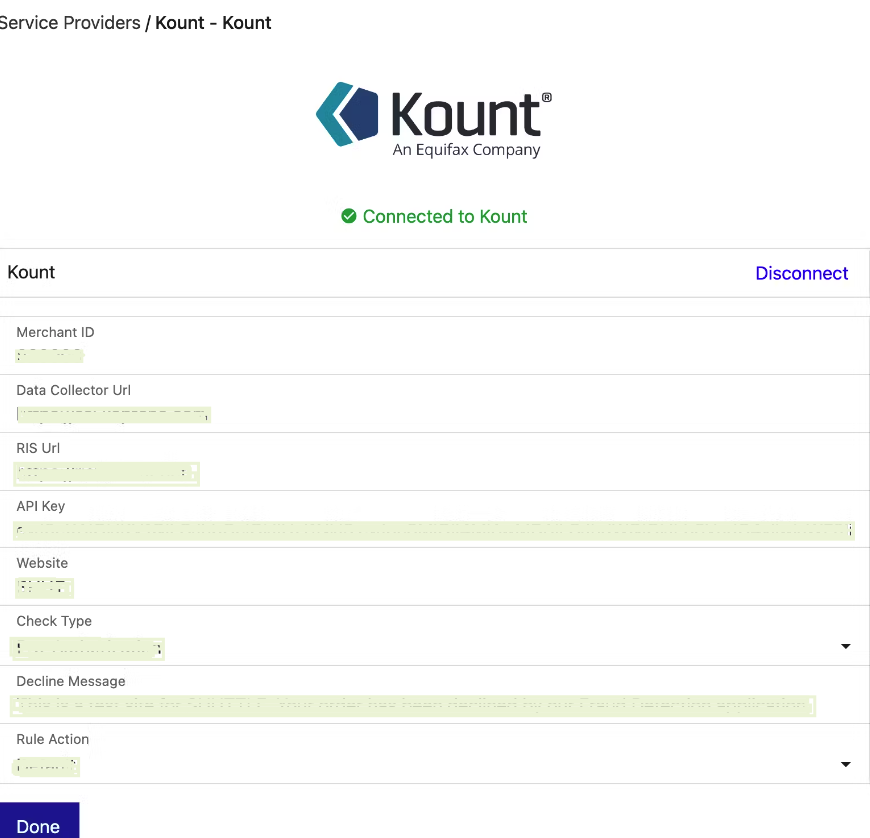

- If we head over to our configuration screen, you’ll find Kount listed amongst the other payment services and gateways.

- If you haven’t purchased Kount yet then you will need to onboard with them using the Shuttle partner link.

- If you’re already a Kount user or your software vendor is, then you’ll then need to enter your Kount credentials, which will be supplied by either Kount of your software vendor.

Now, let’s look at the Kount configuration

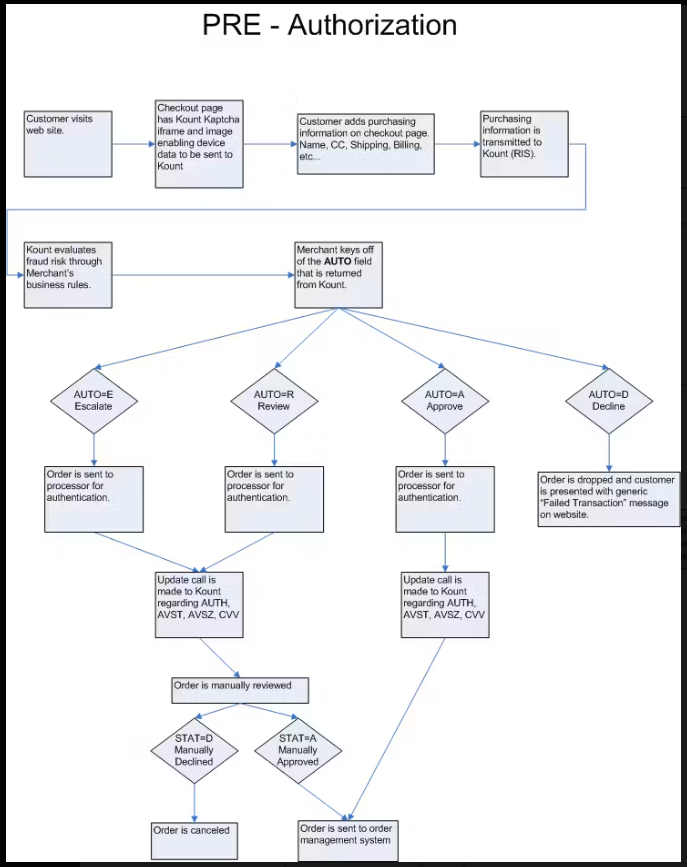

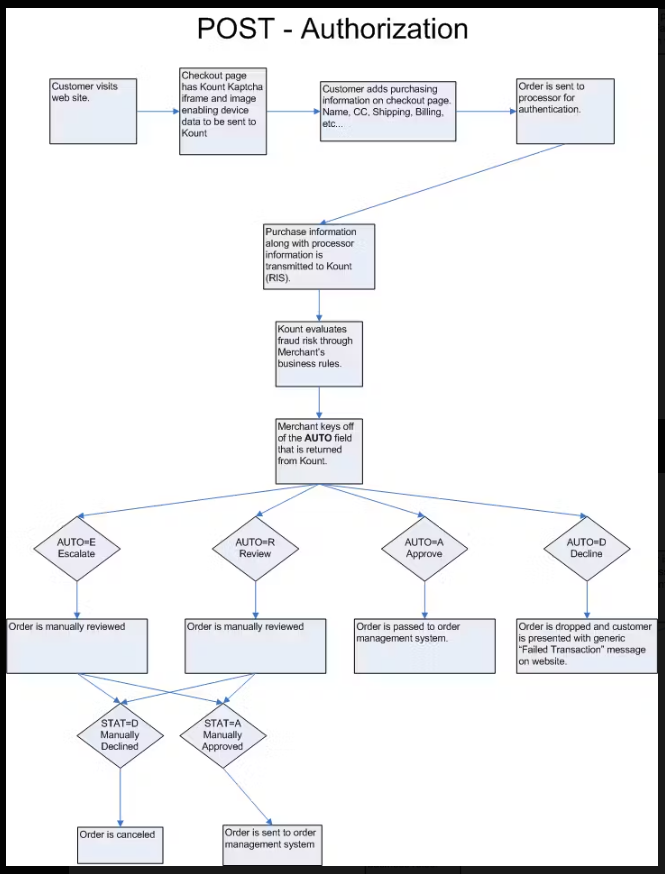

- If you’re using Portfolio mode you will need to have Check Type set to Pre-Authorization, which means unless the transaction passes Kount’s rules it will not be sent to the payment processor. In Portfolio mode, because the merchant does not have a Kount login they cannot manually accept or decline the order post-payment.

- Post-Authorization means that the payment will be passed to the payment gateway along with any relevant data and Kount will determine it rule-set after the payment has been taken.

- Under Decline Message you can type a customer facing message to help them understand what’s happened if their transaction and order gets declined.

- Rule Action is important:

- If you’re using Portfolio mode we recommend that you use the ‘Stop On Escalate/Review’ setting, this will stop orders that look fraudulent and send the decline message to the customer.

- For the Enterprise mode we suggest using ‘Default’ which means that the transaction and therefore the order will be placed into a pending status, the customer will be informed that their order is pending. The merchant can then review why the order was stopped and manually proceed or decline.

- ‘Always Allow Payment’ will let allow all transactions through regardless of what Kount believes. The decline or success message will be logged against the transaction. The merchant can then review these manually and do whatever they want with the order process.

Once Kount is enabled every transaction will adhere to your configuration.

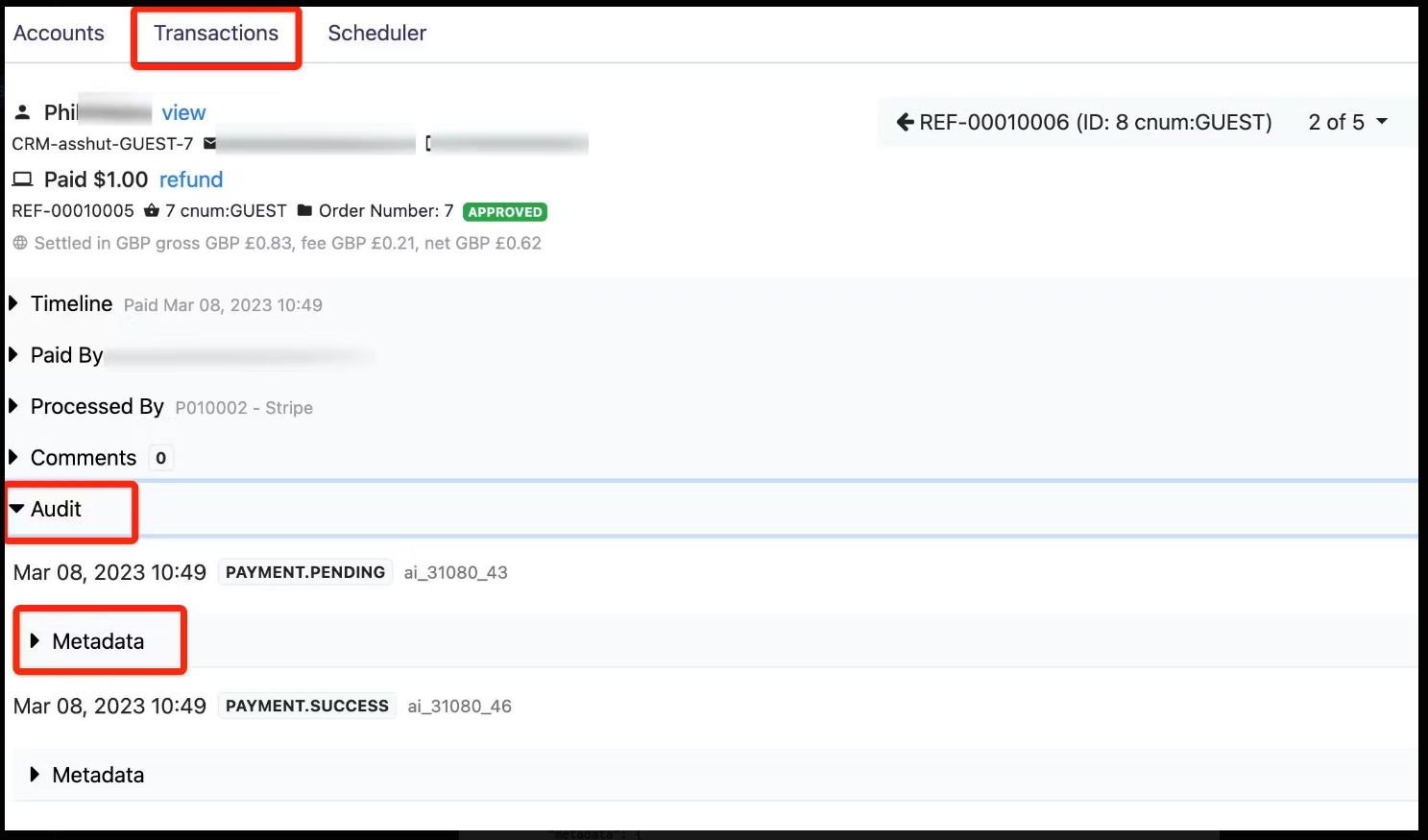

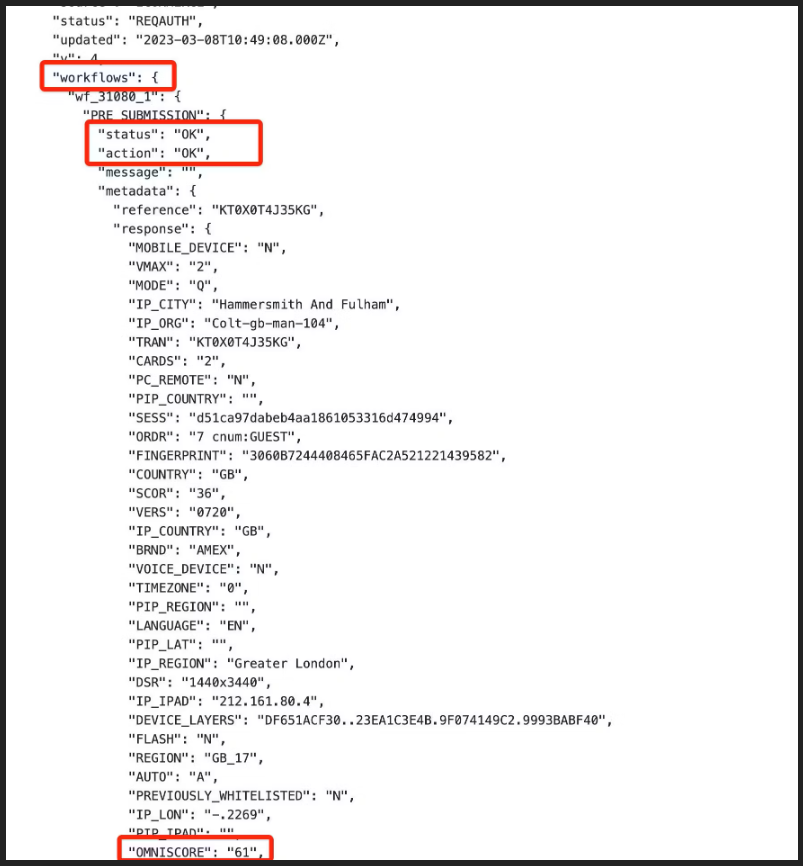

The software platform that is enabling Kount features via Shuttle can build a UI on top of Shuttle’s workflow APIs to show the feedback from Kount on every transaction. If the software platform hasn’t built this UI, the merchant can find out the Kount data for a transaction under the AUDIT section of the Merchant View.

What payment methods does Kount work with?

Kount only displays for “Card”, “SEPA” and “ACH” only. That means it DOESN’T work for:

- Any hosted process (eg GoCardless, Mollie, Paypal, Klarna etc)

- Hosted card processes e.g. Transbank

- Hosted ACH processes e.g. the Stripe ACH upgrade (open banking)

- Hosted SEPA processed e.g.Mollie

- Integrated iFrames payment processes, e.g. Paypal cards form inside their iFrame

Kount’s Pre-Authorization vs Post-Authorization